Certified-Circular Plastic Market Trends 2026-35

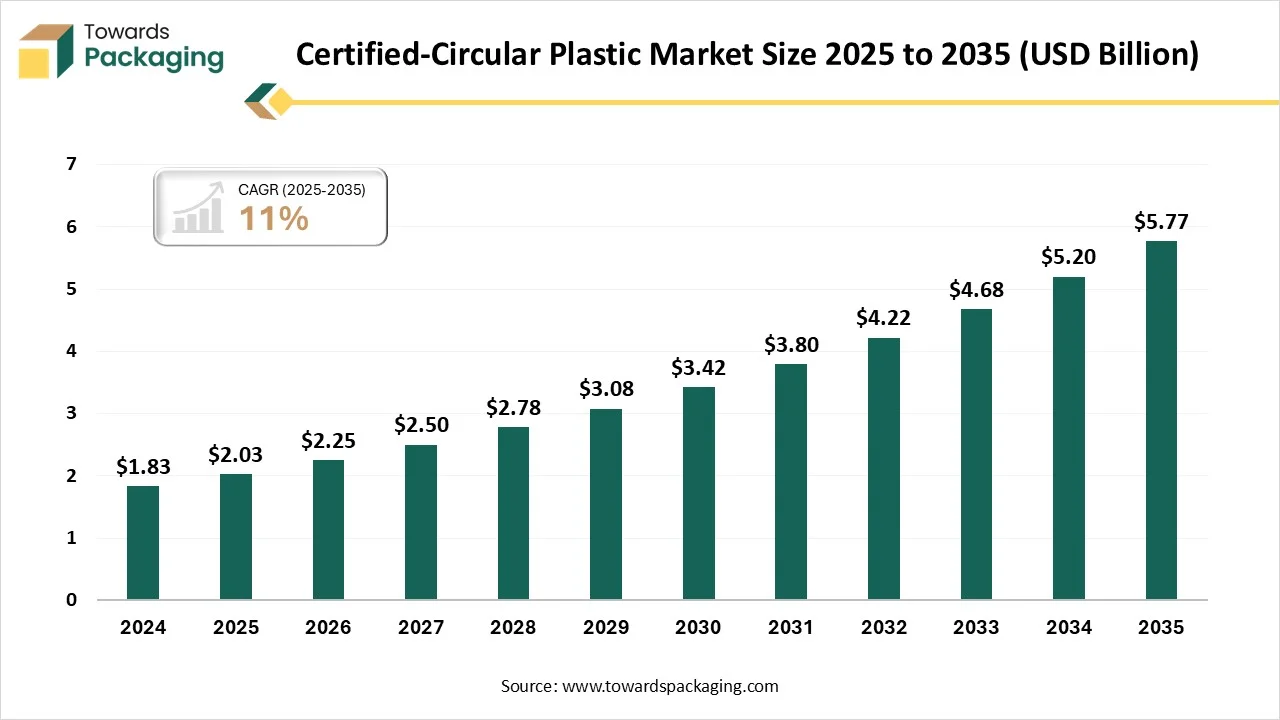

According to researchers from Towards Packaging, the global certified-circular plastic market, estimated at USD 2.03 billion in 2025, is forecast to expand to USD 5.77 billion by 2035, growing at a CAGR of 11% over the forecast period.

Ottawa, Feb. 09, 2026 (GLOBE NEWSWIRE) -- The global certified-circular plastic market hit USD 2.03 billion in 2025, with current forecasts pointing to USD 5.77 billion by 2035, according to Towards Packaging, a sister firm of Precedence Research. Technological advancements and the increasing need for investments in infrastructure development fuel this growth and drive the certified-circular plastic market's growth.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Certified-Circular Plastic?

Certified circular plastic refers to materials produced from recycled, formerly hard-to-recycle plastic waste, often via advanced/chemical recycling, which are verified by independent third parties such as ISCC PLUS, to meet specific sustainability criteria. It enables, through mass balance accounting, the creation of virgin-quality, food-grade, or medical-grade plastic, reducing dependency on fossil-based raw materials.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5945

Major Government Initiatives for Certified-Circular Plastic Industry:

- UN Global Plastics Treaty: A legally binding international agreement currently being finalized to address the full lifecycle of plastic, from production and design to waste management.

- EU Circular Economy Act: A comprehensive policy framework aimed at creating a single market for secondary raw materials by mandating recycled content in new plastic products.

- National Action Plan for Circular Economy (India): A strategic roadmap that prioritizes the plastic sector for resource efficiency, focusing on scaling up chemical recycling and standardized material recovery.

- Extended Producer Responsibility (EPR) Frameworks: A global regulatory shift that mandates plastic producers take full financial and operational responsibility for the collection and recycling of their products.

- The Global Commitment (UNEP/EMF): A coordinated effort between national governments and industry leaders to ensure 100% of plastic packaging is reusable, recyclable, or compostable by set deadlines.

- Global Plastic Action Partnership (GPAP): A collaborative platform that helps governments translate high-level environmental goals into localized investment roadmaps and data-driven plastic policies.

What are the Latest Key Trends in the Certified-Circular Plastic Market?

- Chemical Recycling Expansion: Significant investment in technologies like pyrolysis and enzymatic recycling, allowing for the breakdown of plastics into high-quality, virgin-like materials, fuels growth.

- Digital Traceability: Increased adoption of digital tools, such as QR codes and blockchain, for traceability of materials to ensure compliance and transparency increases demand.

-

Closed-Loop Partnerships: A surge in collaboration between packaging, consumer goods, and chemical companies to create closed-loop, sustainable, and circular systems supports growth.

What is the Potential Growth Rate of the Certified-Circular Plastic Industry?

The certified-circular plastics industry growth is driven by drivers, including strict regulations for mandatory recycled content, high demand for sustainable packaging, and rapid advancements in chemical recycling technologies, which fuel the growth of the market. Other key growth factors are enhanced traceability through certifications like ISCC RecyClass and corporate sustainability goals, which are also accelerating adoption across the packaging, automotive, and consumer goods sectors.

More Insights of Towards Packaging:

- Pharmaceutical Packaging Machines Market Size and Segments Outlook (2026–2035)

- Smart Containers Market Size, Trends and Regional Analysis (2026–2035)

- Die-Cut Boxes Market Size, Trends and Regional Analysis (2026–2035)

- Expanded Polystyrene for Packaging Market Size, Trends and Segments (2026–2035)

- Beverage Packaging Machine Market Size, Trends and Competitive Landscape (2026–2035)

- Lubricant Containers Market Size, Trends and Competitive Landscape (2026–2035)

- Glass Container Market Size and Segments Outlook (2026–2035)

- Plastic Bottles and Containers Market Size, Trends and Regional Analysis (2026–2035)

- Plastic-Free Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Vial Cap Sealing Machine Market Size and Segments Outlook (2026–2035)

- Food Packaging Films Market Size and Segments Outlook (2026–2035)

- Medical Tubing and Catheters Market Size and Segments Outlook (2026–2035)

- Disposable Food Containers Market Size, Trends and Regional Analysis (2026–2035)

- Polyethylene Mailers Market Size and Segments Outlook (2026–2035)

- Packaging Tapes Market Size, Trends and Competitive Landscape (2026–2035)

- Polyethylene Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Tape Dispenser Market Size and Segments Outlook (2026–2035)

- Pet Care Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Stick Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Renewable Gable-Top Cartons Market Size, Trends and Competitive Landscape (2026–2035)

Regional Analysis:

Who is the Leader in the Certified-Circular Plastic Market?

Europe dominated the global market by holding the highest market share of approximately 35-38% in 2025, supported by strict EU regulations on recycled content, plastic taxes, and extended producer responsibility (EPR) frameworks. The region emphasizes traceability and sustainability certifications, driving the adoption of mass-balance and mechanically recycled certified materials. Brand owners and packaging converters increasingly use certified circular polymers to comply with regulatory requirements and reduce carbon footprints, particularly in food-grade and high-performance applications.

Germany Certified-Circular Plastic Market Growth Trends

Germany plays a leading role in Europe’s market due to its strong recycling infrastructure, advanced chemical industry, and strict waste management policies. Major polymer producers and converters actively adopt certification schemes to meet sustainability goals and customer demand for traceable recycled content. Germany’s automotive and packaging sectors are major drivers, integrating certified circular materials to meet both regulatory and corporate environmental commitments.

How is Asia Pacific Expected to Experience Growth in the Certified-Circular Plastic Industry?

Asia Pacific is expected to experience significant growth in the market in the forecast period, as governments strengthen plastic waste management policies and multinational brands expand sustainable packaging initiatives in the region. Rapid industrialization, growing consumer awareness, and increasing investment in advanced recycling facilities are supporting certified circular plastic adoption. Export-oriented manufacturers also adopt certification schemes to comply with sustainability requirements from global customers in Europe and North America.

China Certified-Circular Plastic Market Growth Trends

China is a key country driving regional demand due to strong circular economy policies, technological leadership in recycling systems, and corporate sustainability strategies. Japanese packaging and electronics manufacturers increasingly use certified circular plastics to enhance product sustainability and meet global compliance standards. The country’s focus on material efficiency and waste reduction supports long-term growth in certified polymer adoption.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Plastic Type Insights

How did the Certified Circular Polyethylene Segment Dominate the Certified-Circular Plastic Market?

The certified circular polyethylene segment dominated the market with a share of 40% in 2025, as brand owners and converters seek sustainable alternatives to virgin PE without compromising performance. Produced using advanced recycling technologies such as chemical recycling and mass balance approaches, it retains identical properties to conventional polyethylene. Demand is particularly strong in packaging, consumer goods, and flexible films, where regulatory pressure and corporate sustainability targets push companies toward certified circular content with traceable environmental credentials.

The certified circular polypropylene segment is projected to grow at the fastest rate in the market in the forecast period, since gaining attention across rigid packaging, automotive parts, and consumer products due to its balance of strength, chemical resistance, and lightweight characteristics. Manufacturers increasingly adopt mass balance certified PP to reduce fossil feedstock dependency while meeting circular economy goals.

The material supports high-performance applications where mechanical recycling may be limited, and its compatibility with existing processing infrastructure accelerates adoption among industries seeking low-carbon material alternatives.

Certification Type Insights

How did the Recycled Content Certified Segment Dominate the Certified-Circular Plastic Market?

The recycled content certified segment dominated the market with a share of 50% in 2025, as it is used in plastic production, ensuring transparency and traceability across the value chain. Standards such as mass balance certification enable manufacturers to claim sustainable content even when physical traceability is complex.

Growing regulatory mandates, extended producer responsibility (EPR) policies, and consumer demand for eco-friendly packaging continue to drive the adoption of recycled content certified circular plastics in global supply chains.

The carbon / environmental impact certified segment is projected to grow at the fastest rate in the market in the forecast period, focusing on verifying reduced greenhouse gas emissions, lower carbon footprints, and improved lifecycle performance of circular plastics. These certifications help companies demonstrate measurable progress toward net-zero commitments and environmental sustainability goals.

Industries such as automotive, electronics, and premium packaging increasingly use certified materials to meet ESG reporting requirements and differentiate products through verified environmental performance metrics.

Application Type Insights

Which Application Segment Dominates the Certified-Circular Plastic Market?

The flexible & rigid packaging segment dominated the market with a share of 55% in 2025, driven by brand commitments toward sustainability, regulatory pressure to reduce virgin polymer use, and rising consumer preference for environmentally responsible packaging. Certified circular plastics, produced through advanced recycling and mass balance approaches, allow manufacturers to maintain performance standards while lowering carbon footprints.

The automotive components segment is projected to grow at the fastest rate in the market in the forecast period, as it is a key growth area for certified circular plastics as OEMs pursue carbon neutrality and sustainable material sourcing across vehicle platforms. These plastics are used in interior trims, under-the-hood components, housings, and structural parts where durability and safety standards remain critical.

The ability of certified circular plastics to match virgin resin performance while contributing to lifecycle emission reductions supports their integration into lightweighting strategies, EV manufacturing, and sustainability-driven procurement initiatives within the automotive industry.

End-Use Industry Insights

How did the Food and Beverages Packaging Segment Dominate the Certified-Circular Plastic Market?

The food & beverages packaging segment dominated the market with a share of 38% in 2025, as global brands shift toward sustainable packaging solutions while maintaining food safety and performance standards. Certified circular PE and PP are increasingly used in films, bottles, caps, and containers due to their virgin-like quality and regulatory compliance. Retailers and FMCG companies drive demand through commitments to increase recycled and circular content in packaging, accelerating market expansion.

The automotive & transportation segment is projected to grow at the fastest rate in the market in the forecast period, as they are adopted to reduce vehicle carbon footprints while maintaining performance, durability, and lightweighting benefits. Circular PP and PE are used in interior trims, underbody components, and non-structural parts where sustainability goals align with cost efficiency.

Automakers leverage certified materials to meet regulatory emissions targets, corporate ESG objectives, and consumer expectations for environmentally responsible mobility solutions.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Recent Breakthroughs in the Certified-Circular Plastic Market

In January 2025, the Indian Institute of Packaging (IIP), Delhi, in collaboration with the Plastics Packaging Research & Development Centre (PPRDC). Companies have collaborated to launch a three-month Professional Certificate Course on Plastics Packaging & Recycling.

In October 2025, Syensqo launched the industry's first portfolio of certified-circular high-performance elastomers and lubricant fluids. This move makes Syensqo a leader in the circular polymer industry.

In June 2025, Singapore-based Circular Plastics Company (CPC) launched a high-tech PET bottle recycling plant in Vietnam. This facility expands CPC's presence in Southeast Asia, building on its operations in Myanmar.

Top Companies in the Certified-Circular Plastic Market & Their Offerings:

- ExxonMobil & Valgroup: Use advanced recycling technology to produce certified-circular polymers for high-performance collation shrink films and food packaging.

- Dow: Offers the REVOLOOP™ portfolio of certified circular resins, including r-HDPE and r-LDPE, for use in shrink films and industrial applications.

- SABIC: Provides certified circular polyethylene and polypropylene through its TRUCIRCLE™ initiative by processing feedstock from mixed plastic waste.

- BASF: Converts plastic waste into pyrolysis oil via its ChemCycling® project to manufacture new, high-performance Ccycled® plastics.

- Tesco: Facilitates the collection of soft plastics to be chemically recycled into food-grade packaging, such as cheese wrappers.

- Lucro Plastecycle: Upcycles post-consumer flexible waste and Ocean Bound Plastic into high-quality granules and recycled packaging films.

- ReCircle: Operates as a recovery enterprise that provides brands with traceable, ethically sourced circular plastic feedstocks.

- Banyan Nation: Produces high-quality, human-contact-safe recycled resins from post-consumer waste for the FMCG bottle industry.

- Berry Global: Manufacturers food-grade containers and flexible packaging using certified circular resins sourced from chemical recycling partners.

- Unilever: Integrates certified circular polymers into consumer packaging, such as ice cream tubs and bouillon containers, to reduce virgin plastic use.

Segment Covered in the Report

By Plastic Type

- Certified Circular Polyethylene (PE)

- HDPE (High-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- LLDPE (Linear Low-Density Polyethylene)

- Certified Circular Polypropylene (PP)

- Homopolymer PP

- Copolymer PP

- Certified Circular PET (Polyethylene Terephthalate)

- rPET (Recycled Polyethylene Terephthalate)

- PET bottles

- Certified Circular PVC (Polyvinyl Chloride)

- rPVC (Recycled Polyvinyl Chloride)

- Certified Circular Polystyrene (PS)

- HIPS (High Impact Polystyrene)

- GPPS (General Purpose Polystyrene)

- Certified Circular Engineering Plastics

- rPA (Recycled Polyamide)

- rPC (Recycled Polycarbonate)

- rPBT (Recycled Polybutylene Terephthalate)

- Other Certified Circular Polymers

- Other recyclable polymers

- Bio-based certified polymers

By Certification Type

- Recycled Content Certified

- Post-consumer recycled (PCR) content

- Post-industrial recycled (PIR) content

- Circular Economy / Loop Certified

- Cradle-to-cradle certification

- Loop certification

- Chain-of-Custody Certified

- Certified supply chain traceability

- Verified chain-of-custody certification

- Carbon / Environmental Impact Certified

- Carbon neutral certification

- Environmental impact reduction certification

- Multi-Standard Certification

- Combined recycled content & carbon footprint certified

- Circular economy & recycled content certified

By Application

- Flexible Packaging

- Pouches

- Films & Wraps

- Bags & Sacks

- Rigid Packaging

- Bottles & Containers

- Crates & Pallets

- Automotive Components

- Consumer Electronics & Appliances

- Construction & Building Materials

- Textiles & Fibers

- Industrial & Agricultural Applications

- Other End Uses

By End-Use Industry

- Food & Beverages

- Personal Care & Household Products

- Pharmaceuticals & Healthcare

- Automotive & Transportation

- Electronics & Electrical

- Construction & Industrial

- Textile & Apparel

- Others (Sports, Toys, etc.)

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5945

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Lightweight Aluminum Beverage Cans Market Size, Trends and Regional Analysis (2026–2035)

- Recyclable Polyethylene-based Laminates Market Size and Segments Outlook (2026–2035)

- Agricultural Films Market Size, Trends and Regional Analysis (2026–2035)

- Recycled PET Bottles Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Sustainable Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Cardboard Sheet Market Size, Trends and Segments (2026–2035)

- Non-cushioned Mailers Market Size, Trends and Competitive Landscape (2026–2035)

- Aerosol Cans Market Size, Trends and Segments (2026–2035)

- North America Flexible Packaging Market Size, Trends and Regional Analysis (2026–2035)

- BOPP Films Market Size, Trends and Competitive Landscape (2026–2035)

- Protective Films Market Size, Trends and Segments (2026–2035)

- Parenteral Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Converted Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Compostable Tableware Market Size, Trends and Regional Analysis (2026–2035)

- Trigger Spray Bottle Market Size, Trends and Competitive Landscape (2026–2035)

- Plastic Container Market Size, Trends and Regional Analysis (2026–2035)

- Temperature Controlled Packaging Solutions Market Size, Trends and Segments (2026–2035)

- Biodegradable Cutlery Market Size, Trends and Competitive Landscape (2026–2035)

- Specialty Films Market Size, Trends and Competitive Landscape (2026–2035)

- Corrugated Bubble Wrap Market Size, Trends and Regional Analysis (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.